When you’re facing foreclosure, one of the most important things you can do is to reach out to a Chicago foreclosure lawyer to help you litigate the legal process and protect your rights. Unfortunately, so many people with foreclosures haven’t taken this step and end up dealing with foreclosure alone, which almost always results in adverse consequences for them, like damaging their credit or losing their homes to the bank. But if you’re faced with foreclosure, don’t make that mistake. Contact our team at Therman Law Offices, LTD today. With a Juris Degree from DePaul University in Chicago, Charles Therman has made a name for himself by effectively handling some of the most serious wrongful death, traumatic brain injury, personal injury, auto injury, and work-related injury cases. We offer free case evaluations, so reach out to us today.

Table Of Contents

Understanding Foreclosure

A foreclosure is when you lose your home to another party. There are two types of foreclosures: judicial and non-judicial. Non-judicial foreclosures (the vast majority) require you to make payments and generally only occur if you miss several payments or are more than 90 days late on your mortgage. In judicial foreclosures, there is some type of legal action involved because of unpaid taxes, overdue assessments, or other issues with your property. When you have a judicial foreclosure, it can take much longer for someone else to take over ownership of your home. If you’re facing either type of foreclosure in Chicago, it’s best to get professional help from our team of professionals.

Avoiding Foreclosure

You want to avoid foreclosure if possible. A foreclosure can be devastating to your credit rating, and it’s unlikely that you will be able to buy another home anytime soon afterward. If you are facing foreclosure on your primary residence, you must contact an attorney immediately who can advise and assist you throughout the process. A lawyer with our firm can also help prevent further complications with your lender and make sure all of your rights are being upheld during negotiations. It is especially important to retain legal counsel if you have any mortgage refinancing options available, such as the Home Affordable Refinance Program (HARP) or government-backed loan modification programs. Failing to utilize these resources could mean throwing away money for no reason at all. Our experienced Chicago foreclosure lawyers can walk you through these programs and explain your options so that you don’t lose money unnecessarily or become stressed out over something that could have been avoided. The best way to fight foreclosure is by contacting a skilled professional in Illinois as soon as possible.

Alternatives to Foreclosure

Your first line of defense when facing foreclosure is to work directly with your lender. That’s because 90% of foreclosures are resolved through short sales, deeds-in-lieu of foreclosure, or loan modifications. As long as you meet certain qualifications, it’s likely that you can avoid going into foreclosure altogether and get back on track with your mortgage payments. The best way to start is by contacting your lender directly. Your lender will work with you to determine whether you qualify for one of these alternative options. If not, they’ll usually refer you to an outside company that will try and help you get caught up on your payments and keep ownership of your home in place. You can probably handle a lot of things on your own, but when it comes to foreclosure, that’s something to leave in professional hands. Without legal counsel, you may miss out on any number of valuable legal defenses and opportunities to negotiate with your lender and prolong (or even avoid) foreclosure. We make sure everything is done legally and professionally so that you have as many tools at your disposal as possible when working to prevent foreclosure. With careful planning and strong legal representation, there’s every reason to believe that you can get back on track without losing your home.

Hiring legal representation may not be your only option, but it is one you should consider. You can probably handle a lot of things on your own, but when it comes to foreclosure, that’s something to leave in professional hands. Without legal counsel, you may miss out on any number of valuable legal defenses and opportunities to negotiate with your lender and prolong (or even avoid) foreclosure. An attorney can make sure everything is done legally and professionally so that you have as many tools at your disposal as possible when working to prevent foreclosure. With careful planning and strong legal representation, there’s every reason to believe that you can get back on track without losing your home.

Illinois Home Ownership

A distinct feature of Illinois law is its emphasis on transparent communication. Before any actual legal action can commence, the lender must provide a grace period, during which the homeowner can make up for missed payments. If this doesn’t happen, the lender must then send a notice of intent to begin legal proceedings, offering the homeowner a final chance to address the default. Unlike some states that allow non-judicial foreclosures, Illinois mandates a judicial process. This means that the lender must file a lawsuit and prove their right to foreclosure in court. Homeowners are allowed to present their defense, making certain due process is maintained. This approach offers an extra layer of protection for homeowners, guaranteeing their right to a fair hearing. Homeowners have a redemption period, usually lasting up to seven months from the notice or three months from the judgment, whichever is later.

During this period, the homeowner can buy back or “redeem” their property by paying the full mortgage amount and all associated costs. Additionally, they can also reinstate the loan by covering missed payments, late fees, and related legal fees within 90 days of the foreclosure notice. In cases where the sale of a foreclosed home doesn’t cover the outstanding loan amount, Illinois law provides certain protections for homeowners. While lenders can seek a deficiency judgment for the remaining balance, the state caps the amount they can recover. This provision helps to mitigate the financial burden on homeowners who are already grappling with the loss of their property.

The Steps of Filing for Foreclosure

Filing for foreclosure is a process that no homeowner wants to go through. Unfortunately, it is sometimes an inevitable reality. Whether due to financial difficulties, divorce, or other problems, homeowners may find themselves unable to keep up with mortgage payments. In such cases, filing for foreclosure may be the only option.

Begin The Process by Issuing the Notice of Default

When a homeowner falls behind on mortgage payments, the lender initiates the foreclosure process by issuing a notice of default. This notice serves as a warning to the homeowner that they are in breach of the loan’s terms and that the lender is considering taking legal action. The notice will typically give the homeowner a period of time, usually thirty days, to bring their mortgage payments up to date before the next step is taken. The homeowner must take this time seriously and try to reach an agreement with the lender to restructure their debt.

The Homeowner Must Obtain the Lis Pendens Notice

If the homeowner does not cure the default within the notice period, the lender will proceed to file a lis pendens notice. This notice indicates that legal proceedings have been started, and the property is subject to foreclosure. At this point, the homeowner has a set number of days (typically 20-30) to respond to the notice. If the homeowner does not respond within this time frame, the foreclosure process will continue, and a court hearing will be scheduled.

Time for Homeowner to Challenge Lender Proceedings

If the homeowner does respond, they may have an opportunity to challenge the lender’s proceedings, file a response with the court with the help of a foreclosure lawyer, and request a hearing. If the homeowner can show that they can catch up on their mortgage payments or find an alternative solution, the foreclosure process may be stopped. However, if the homeowner cannot come up with a solution, the court will proceed with the foreclosure process.

Auctioning the Property

The final step of foreclosure is the sale of the property at auction. At this point, the homeowner has lost all possession rights to the property. The property will be sold to the highest bidder, and any proceeds will go to the lender to repay any outstanding debts. If the proceeds from the sale are greater than the amount owed to the lender, the homeowner may receive the excess funds. Filing for foreclosure is a challenging process for any homeowner. To avoid foreclosure, communication is paramount. The best advice is to contact the lender as soon as possible when payments cannot be made. By following these steps, homeowners may avoid common pitfalls and be better equipped to manage the foreclosure process.

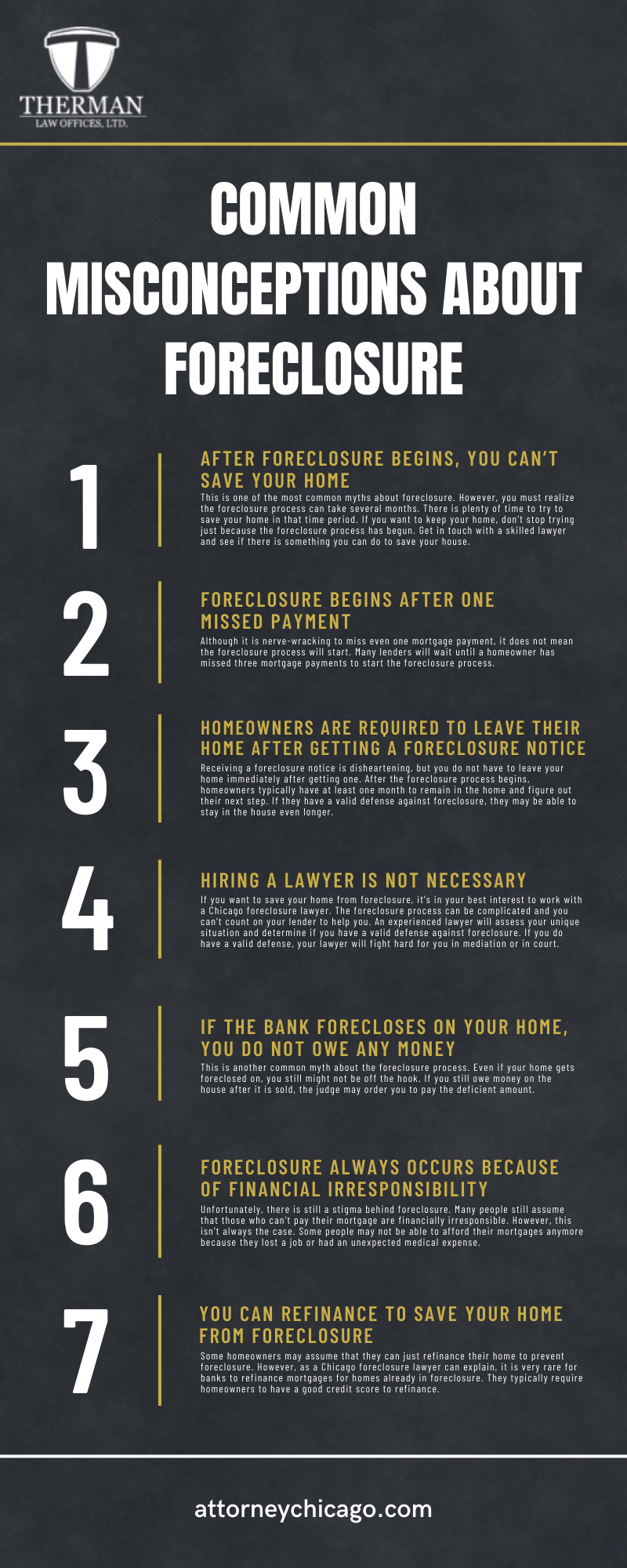

Common Misconceptions About Foreclosure

If you are facing foreclosure, you may want to get in touch with our office. The thought of losing something you worked so hard for is devastating. However, it may still be possible to save your home. Here are some common misconceptions about foreclosure.

- After foreclosure begins, you can’t save your home

This is one of the most common myths about foreclosure. However, you must realize the foreclosure process can take several months. There is plenty of time to try to save your home in that time period. If you want to keep your home, don’t stop trying just because the foreclosure process has begun. Get in touch with one of our skilled lawyers and see if there is something you can do to save your house.

- Foreclosure begins after one missed payment

Although it is nerve-wracking to miss even one mortgage payment, it does not mean the foreclosure process will start. Many lenders will wait until a homeowner has missed three mortgage payments to start the foreclosure process.

- Homeowners are required to leave their homes after getting a foreclosure notice

Receiving a foreclosure notice is disheartening, but you do not have to leave your home immediately after getting one. After the foreclosure process begins, homeowners typically have at least one month to remain in the home and figure out their next step. If they have a valid defense against foreclosure, they may be able to stay in the house even longer.

- Hiring a lawyer is not necessary

If you want to save your home from foreclosure, it’s in your best interest to work with a seasoned legal professional. The foreclosure process can be complicated and you can’t count on your lender to help you. With over three decades of combined experience, our lawyers will assess your unique situation and determine if you have a valid defense against foreclosure. If you do have a valid defense, we will fight hard for you in mediation or court.

- If the bank forecloses on your home, you do not owe any money

This is another common myth about the foreclosure process. Even if your home gets foreclosed on, you still might not be off the hook. If you still owe money on the house after it is sold, the judge may order you to pay the deficient amount.

- Foreclosure always occurs because of financial irresponsibility

Unfortunately, there is still a stigma behind foreclosure. Many people still assume that those who can’t pay their mortgage are financially irresponsible. However, this isn’t always the case. Some people may not be able to afford their mortgages anymore because they lost a job or had an unexpected medical expense.

- You can refinance to save your home from foreclosure

Some homeowners may assume that they can just refinance their home to prevent foreclosure. However, it is very rare for banks to refinance mortgages for homes already in foreclosure. They typically require homeowners to have a good credit score to refinance.

Chicago Foreclosure Infographic

Chicago Foreclosure Statistics

According to ATTOM, there were 357,062 foreclosure filings in 2023. These actions include default notices, scheduled auctions, and bank repossessions. This is up 10 percent from 2022 and up 136 percent from 2021. If you are being threatened with foreclosure, it is important to speak with our foreclosure attorney immediately to find out what legal options you may have.

Chicago Foreclosure FAQs

What are the causes of foreclosure?

First and foremost, financial difficulties and the inability to make timely mortgage payments are among the primary causes of foreclosure. Job loss, reduced income, medical emergencies, and mounting debt are all factors that can contribute to a homeowner’s financial instability. When faced with these challenges, homeowners may find it increasingly difficult to meet their mortgage obligations, ultimately leading to foreclosure.

What are common foreclosure issues?

The foreclosure process can be full of obstacles. One significant issue is the loss of their home and the disruption it causes to their lives. Being forced to vacate their property can be emotionally and financially distressing for individuals and their families. The process of finding new housing, uprooting established routines, and dealing with the emotional toll of losing one’s home can be overwhelming. It is important to be aware that foreclosure can impact a person’s credit. A foreclosure is a negative mark on a person’s credit report and can significantly lower their credit score. This can make it difficult to secure future loans, obtain affordable interest rates, or even rent a home. The repercussions of foreclosure can persist for several years, hindering a person’s financial stability and limiting their options.

What are typical financial problems that lead to foreclosure?

It is also common for many homeowners to face other types of financial difficulties when they are dealing with the complicated foreclosure process. In some cases, lenders may pursue a deficiency judgment, which allows them to seek repayment for the outstanding loan balance after the foreclosure sale. This can result in the borrower owing a substantial amount of money even after losing their home. Legal disputes can arise if there are issues with the foreclosure process itself, such as improper documentation or violations of the homeowner’s rights.

When should I consult an attorney?

We highly recommend that individuals seek assistance from one of our qualified lawyers before they make any kind of decision regarding foreclosure. Our legal counsel may provide valuable guidance and support, helping homeowners understand their rights and options. They can review the details of the foreclosure proceedings, ensuring that all legal requirements are met and identifying any potential violations or discrepancies.

What can legal representation do for me?

Skilled legal counsel may provide guidance, protect homeowners’ rights, and explore possible alternatives to foreclosure. Seeking legal assistance promptly can make a significant difference in the outcome and help individuals manage the challenges associated with foreclosure.

Therman Law Offices, LTD, Chicago Foreclosure Lawyer

8501 W Higgins Rd #420 Chicago, IL 60631

Contact Our Chicago Foreclosure Firm Today

The ordeal of a potential foreclosure is undoubtedly overwhelming. However, within the boundaries of Illinois’ structured legal framework, there’s hope for clarity, rights preservation, and possible resolution. If you or someone you know is facing such challenges, remember that you need not tread this path alone. Knowledgeable allies, familiar with every twist and turn of foreclosure laws, can make a world of difference. Let our team at Therman Law Offices, LTD be your trusted guide in this journey. With offices in over 3 locations, you can rest assured we will be there for you. Reach out to our professionals today, and together, we’ll chart a course toward understanding, resolution, and peace of mind.