Learning About Your Options

At Therman Law Offices, LTD, our Chicago bankruptcy lawyer guides our clients through Chapter 7 and Chapter 13 bankruptcies. Known for honest and straightforward solutions, our attorney Charles Therman is here to help you seek the fresh financial start you’re looking for. Call our firm today to get set up with a free initial consultation.

Bankruptcy Costs In Chicago

The cost of filing for bankruptcy in Illinois (or anywhere in the U.S.) varies depending on the type of bankruptcy, the complexity of the case, and the attorney fees. As of 2025, the filing fees for bankruptcy cases are as follows:

- Chapter 7: $338

- Chapter 11: $1,738

- Chapter 13: $313

Attorney fees can vary widely. Chapter 7 attorney fees might range from $1,000 to $2,500, while Chapter 11 attorney fees can be significantly higher due to the complexity of the case. It’s important to consult with an attorney for an accurate estimate based on your specific situation.

Therman Law Offices, LTD is a law firm that could potentially assist individuals and businesses in Chicago with filing for bankruptcy. When choosing a law firm, it’s important to look for experienced attorneys who specialize in bankruptcy law and have a strong track record of helping their clients navigate the bankruptcy process.

How Long Is The Bankruptcy Process In Illinois?

As experienced Chicago Bankruptcy lawyers, we at Therman Law Offices, LTD are committed to providing our clients with clear, professional guidance every step of the way. The duration of the bankruptcy process varies depending on several factors, including the type of bankruptcy filed.

Here, we will delve into the timelines for the most common types of bankruptcies – Chapter 7 and Chapter 13 – and offer insights into how these processes work in Illinois.

Chapter 7 Bankruptcy

Chapter 7 bankruptcy, often known as liquidation bankruptcy, is typically the quicker option. From our extensive experience, we have observed that the entire Chapter 7 process in Illinois can take approximately four to six months from filing to discharge. However, this timeline can vary based on individual circumstances.

Once we file the bankruptcy petition on your behalf, an automatic stay immediately comes into effect, halting most collection activities against you. A meeting of creditors, also known as a 341 meeting, is usually scheduled about a month after filing. This is a straightforward process where the bankruptcy trustee and any interested creditors can ask questions about your financial situation.

Post the 341 meeting, if there are no complications, the process moves relatively quickly. The debtor will need to complete a debtor education course. Provided there are no objections from creditors or the trustee, the bankruptcy court typically issues a discharge about 60 to 90 days after the 341 meeting.

Chapter 13 Bankruptcy

Chapter 13 bankruptcy, on the other hand, is a reorganization bankruptcy intended for individuals with a regular income. This process allows debtors to keep their property and pay back all or a portion of their debts through a repayment plan. In Illinois, these plans last either three or five years, depending on your income.

The timeline for a Chapter 13 bankruptcy is inherently longer due to the repayment plan. The initial stages are similar to Chapter 7, with an automatic stay and a 341 meeting. However, the focus then shifts to the confirmation of the repayment plan by the court. This process can take a few months, as it involves proposing a plan, reviewing creditor objections, and obtaining court approval.

Upon approval of the plan, the debtor begins making payments. The bankruptcy case remains open for the duration of the repayment plan. Once the plan is completed, and all requirements are met, the court will issue a discharge of the remaining eligible debts.

What Are The Income Limits For Bankruptcy In Illinois?

When considering filing for bankruptcy, it’s important to understand how your income can affect your eligibility for different types of bankruptcy. In Illinois, as in other states, income plays a crucial role, especially for Chapter 7 bankruptcy.

Chapter 7

Chapter 7 bankruptcy is designed for individuals with limited income who are unable to pay their debts. To qualify for Chapter 7 bankruptcy, your income must be below a certain level, which is determined by the Means Test.

The Means Test compares your average monthly income over the six months prior to filing to the median income for a household of your size in your state.

As of 2025, here are the approximate annual median income figures for Illinois:

- 1 Person: $66,950

- 2 People: $86,442

- 3 People: $105,897

- 4 People: $125,022

- Add $9,900 for each individual in excess of 4.

If your income is below these figures, you generally qualify for Chapter 7 bankruptcy. If your income is above these figures, you may still qualify, but you will need to provide additional information about your expenses and debts to determine eligibility.

Chapter 13

There are no specific income limits for filing Chapter 13 bankruptcy. However, there are debt limits (secured and unsecured), and you must have a regular income sufficient to make the monthly payments under your repayment plan. The purpose of Chapter 13 bankruptcy is to reorganize your debts and provide a repayment plan based on your income and ability to pay. If you’re considering this chapter for restructuring your debt, read more about the benefits and drawbacks of Chapter 13.

No Income Limits For Chapter 11

Chapter 11 bankruptcy, often used for businesses with significant assets and debts, does not have specific income limits for eligibility.

Success Rate Of Chapter 7

While it’s difficult to provide a specific success rate without access to current and detailed data, it’s generally accepted that the majority of Chapter 7 bankruptcy cases result in a discharge of dischargeable debts, provided the debtor meets all requirements and there is no fraudulent activity.

According to some sources, the success rate could be as high as 95% or more for debtors who complete the process and comply with all requirements. Consulting with a bankruptcy attorney can further increase the chances of a successful outcome.

Factors Influencing Success

- Complete and Accurate Documentation. Providing complete and accurate financial documentation is crucial. If the bankruptcy trustee finds discrepancies or omissions in the paperwork, it could lead to the case being dismissed or converted to a different type of bankruptcy.

- Eligibility. To file for Chapter 7 bankruptcy, debtors must pass the Means Test, which compares their income to the median income in their state for a household of their size. If their income is too high, they may not qualify for Chapter 7 bankruptcy.

- Exempt and Non-Exempt Assets. In a Chapter 7 bankruptcy, the trustee can sell the debtor’s non-exempt assets to pay off creditors. Understanding which assets are exempt and which are not can be complex and may vary by state. Properly categorizing assets can impact the success of the bankruptcy.

- Fraudulent Activity. Any fraudulent activity, such as hiding assets, can lead to a denial of discharge, meaning the debtor would still be responsible for their debts.

- Legal Representation. Having an experienced bankruptcy attorney can significantly increase the chances of a successful Chapter 7 bankruptcy. Attorneys can help make sure that all paperwork is completed accurately, guide debtors through the legal process, and represent the debtor in interactions with the trustee and creditors.

- Attendance Of Required Courses. Debtors must complete credit counseling before filing and a debtor education course after filing. Failure to complete these courses can result in the bankruptcy case being dismissed.

- Cooperation With The Trustee. Debtors must cooperate fully with the bankruptcy trustee, including providing requested documents and information in a timely manner.

Bankruptcy Infographic

Why Is Chapter 11 Bankruptcy So Expensive?

Chapter 11 bankruptcy is known for being significantly more expensive than other types of bankruptcy. There are several factors that contribute to the high costs associated with Chapter 11:

Specifics Of The Case. Chapter 11 cases are typically much more complex than Chapter 7 or Chapter 13 cases. They often involve large amounts of debt, numerous creditors, and complicated financial arrangements. This complexity requires more time and expertise to manage, resulting in higher legal and professional fees.

Legal And Professional Fees. The debtor in a Chapter 11 case often needs to hire attorneys, accountants, and other professionals to assist in preparing the reorganization plan, valuing assets, negotiating with creditors, and performing other necessary tasks. These professionals charge for their services, and their fees can add up quickly, especially in a complex case that takes a long time to resolve.

Duration Of The Case. Chapter 11 cases typically take much longer to resolve than Chapter 7 or Chapter 13 cases. The longer a case takes, the more legal and professional hours are accumulated, and the more expensive the bankruptcy becomes.

Court Costs And Filing Fees. The filing fees for Chapter 11 bankruptcy are higher than for other types of bankruptcy. Additionally, there may be ongoing court costs and fees associated with managing the case.

The Need For A Reorganization Plan. In Chapter 11 bankruptcy, the debtor must create and implement a reorganization plan that details how debts will be repaid or discharged. Developing this plan can be a complex and time-consuming process, requiring input from various stakeholders and negotiations with creditors.

Administrative Expenses. Chapter 11 bankruptcies require ongoing administration, including filing periodic reports and other documents with the court. These administrative tasks require time and resources, contributing to the overall cost.

Potential Litigation. Disputes with creditors or other stakeholders can lead to litigation, which can be expensive and time-consuming.

Size And Scope Of Assets And Debts

Larger companies with substantial assets and debts will generally incur higher costs in a Chapter 11 bankruptcy due to the increased complexity and the greater amount of work required to reorganize or liquidate those assets. The high cost of Chapter 11 bankruptcy is due to the need for professional services, the duration of the process, and the administrative and legal challenges involved.

It is a sophisticated legal tool designed to allow businesses (and in some cases individuals) to restructure their debts while continuing to operate, and the associated costs reflect the level of work and expertise required to navigate this complex process successfully.

Partner With Us For Experienced Bankruptcy Guidance In Chicago

In the complex and often daunting realm of bankruptcy, having a knowledgeable and trustworthy ally is invaluable. Therman Law Offices, LTD stands out as a beacon of reliability and expertise in Chicago, consistently guiding individuals and businesses through the intricacies of bankruptcy with compassion and precision. Our team of seasoned professionals is dedicated to demystifying the process, providing personalized solutions tailored to your unique financial situation.

By choosing our firm, you are not just gaining legal assistance; you are securing a partner committed to safeguarding your interests and facilitating a smoother journey toward financial stability. Let us empower you to regain control of your financial future and embark on a path to recovery and peace of mind.

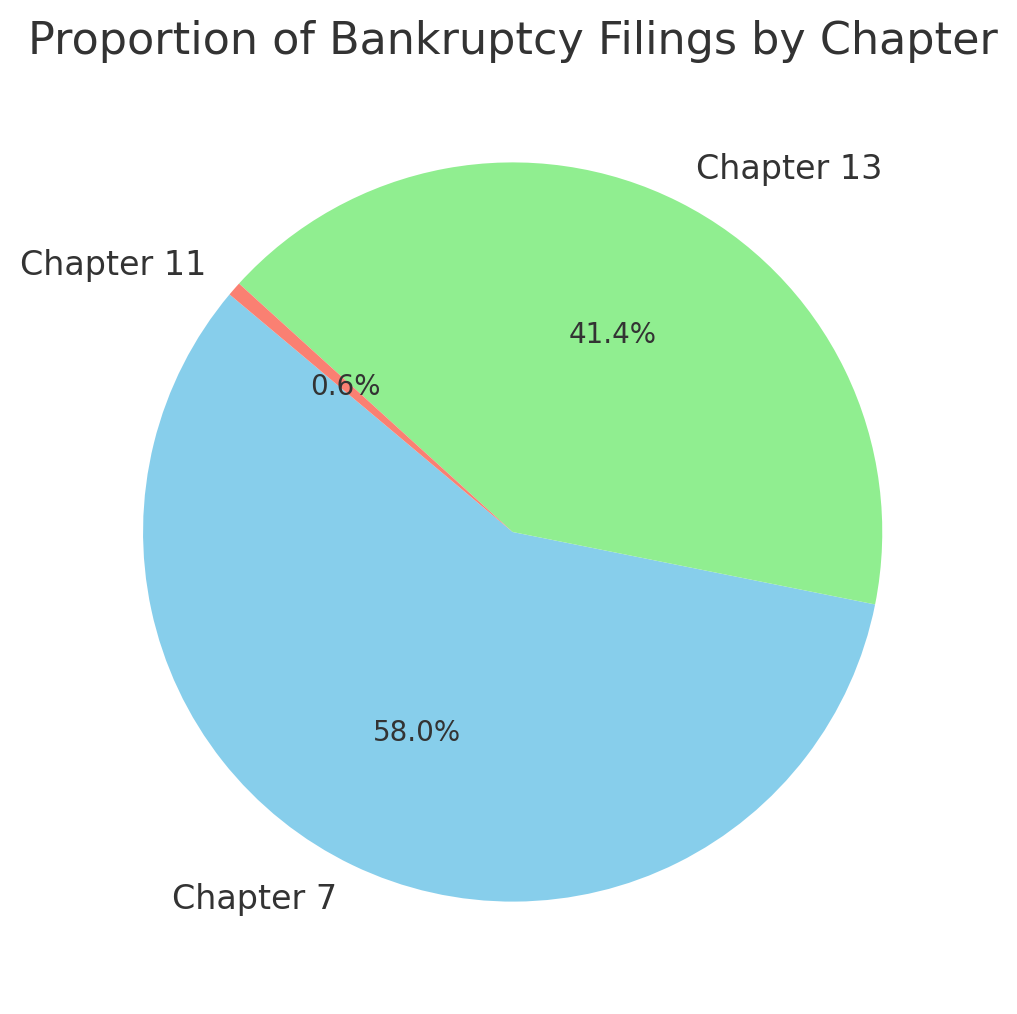

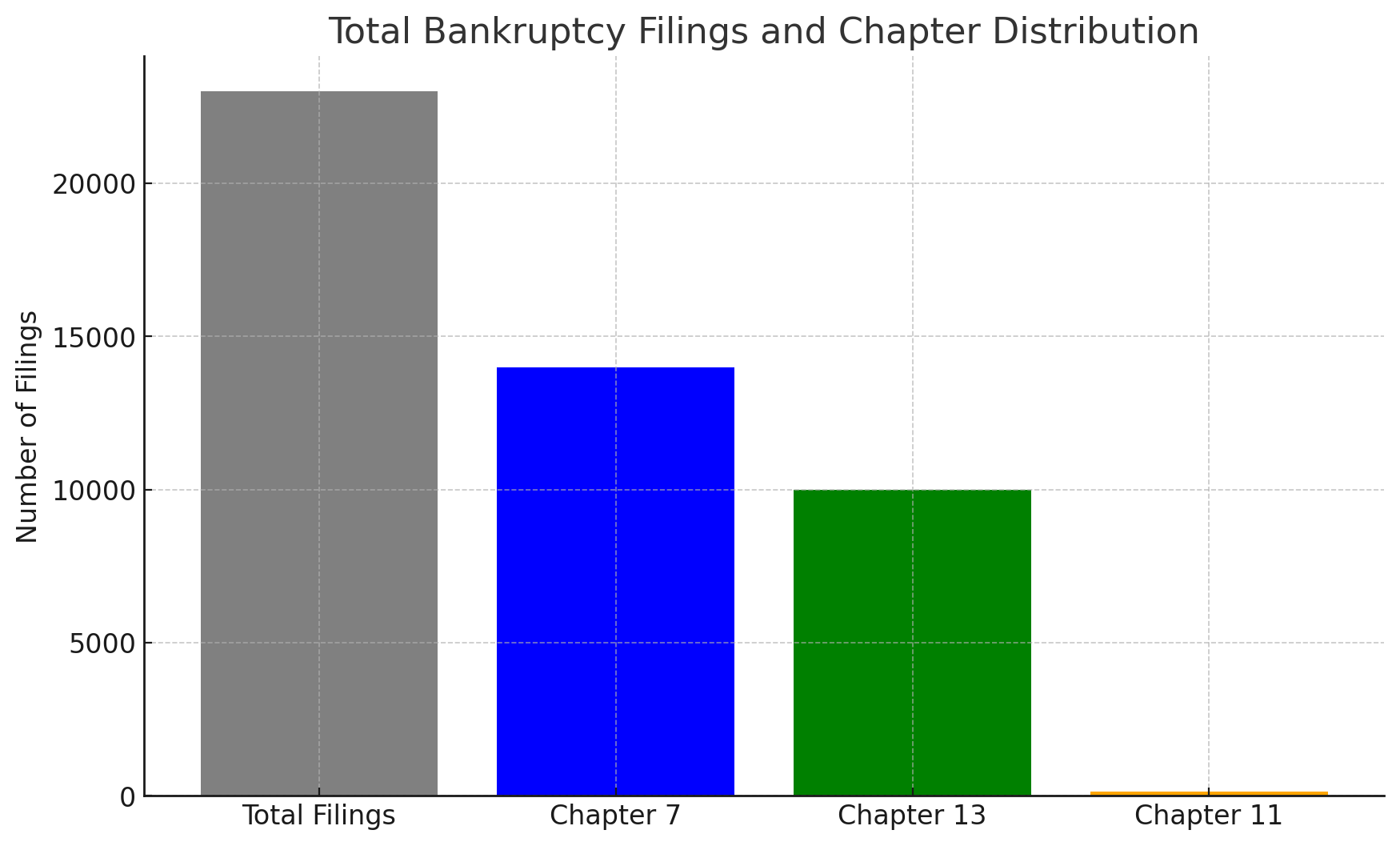

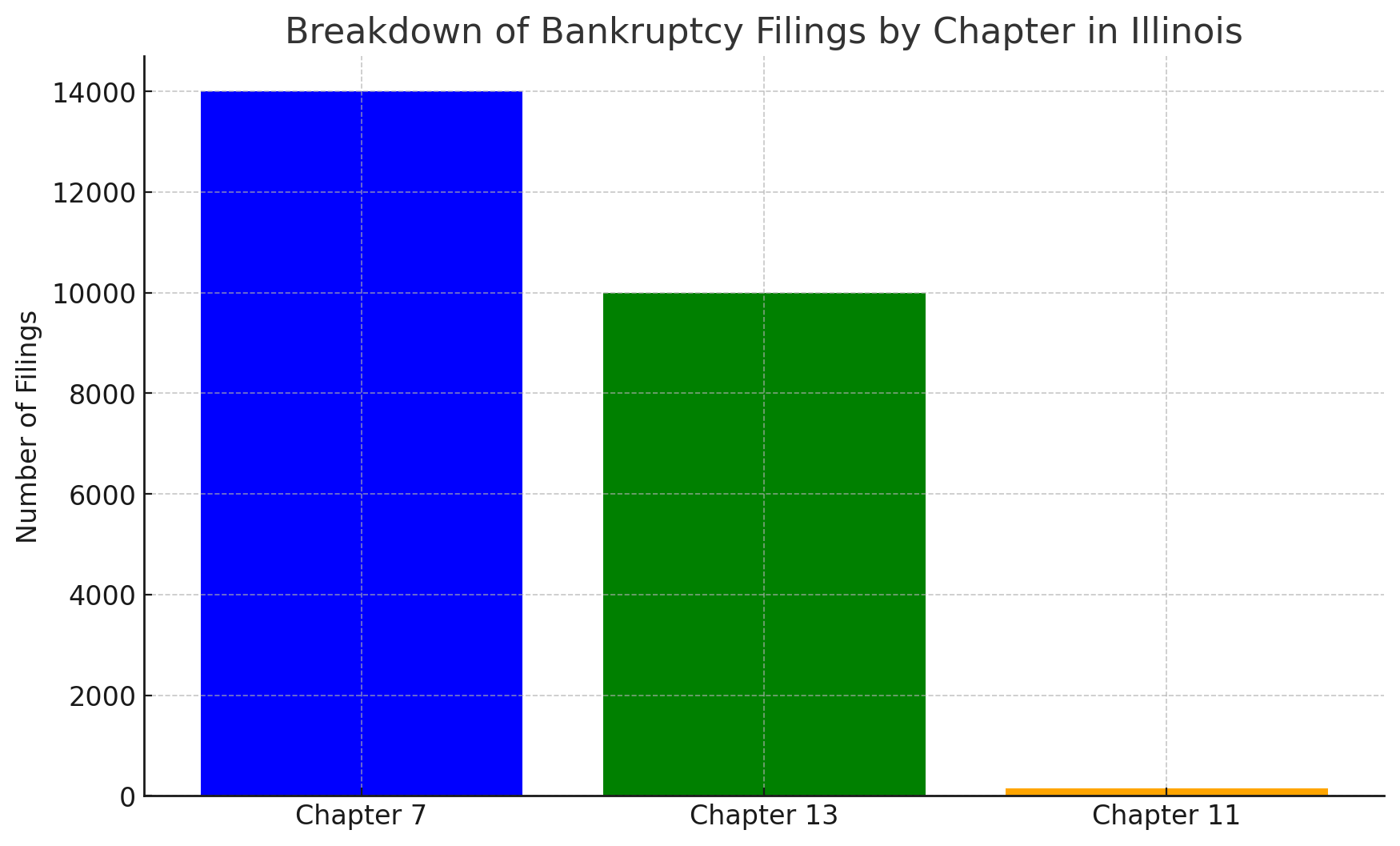

Illinois Bankruptcy Statistics

According to Debt.org, Illinois is one of the states with the highest number of bankruptcy filings. Over 20,000 Illinois residents filed for bankruptcy in 2022. There are approximately 14,000 people who file for Chapter 7 and 10,000 Chapter 13 filers. Another 150 file for Chapter 11.

If you are struggling financially and considering filing, call our office to speak with a dedicated bankruptcy lawyer to learn which type of bankruptcy would benefit you the most.

FAQs

What are the key differences between Chapter 7 and Chapter 11?

Chapter 7 Bankruptcy, often referred to as liquidation bankruptcy, is designed for individuals and businesses who find it difficult to pay off their debts. In Chicago, Chapter 7 involves the liquidation of non-exempt assets by a trustee to pay creditors. It’s typically chosen by individuals with limited income and fewer assets.

On the other hand, Chapter 11 Bankruptcy, known as reorganization bankruptcy, is primarily for businesses. It allows Chicago-based companies to restructure their debts while continuing their operations. Unlike Chapter 7, it doesn’t necessarily involve liquidating assets but focuses on creating a repayment plan while the business stays operational.

Who is eligible for bankruptcy?

For Chapter 7 Bankruptcy in Chicago, eligibility is determined by a means test, which considers your income and expenses. It’s generally suited for individuals with a limited income who can’t pay back their debts. Businesses can also file for Chapter 7, but they must cease operations upon filing.

Chapter 11 Bankruptcy, however, is more commonly used by businesses, including corporations, partnerships, and sole proprietorships in Chicago. Individuals with substantial debts and assets may also opt for Chapter 11 if they exceed the debt limits of Chapter 13 Bankruptcy. There’s no income qualification for Chapter 11, making it a viable option for businesses regardless of their financial status.

What are the consequences of filing for bankruptcy?

Filing for Chapter 7 Bankruptcy in Chicago can result in the loss of certain assets, although exemptions may protect essential items like primary residence and personal belongings. It also significantly impacts your credit score and stays on your credit report for up to 10 years. For businesses, it means ceasing operations.

In contrast, Chapter 11 Bankruptcy allows Chicago businesses to continue operating but under court supervision. It’s a complex and costly process and also affects the credit standing, but it offers a chance to reorganize debts and plan for a more sustainable financial future. Both types can offer relief from certain debts but may not discharge all types of obligations.

How long does the process take?

In Chicago, the Chapter 7 Bankruptcy process is relatively quick, typically taking about 4-6 months from filing to discharge. However, the time can vary depending on the case’s complexity and the court’s schedule.

Chapter 11 Bankruptcy, on the other hand, is more time-consuming due to its complexity. The process can last from a few months to a couple of years. The duration largely depends on how quickly a reorganization plan is developed and approved by creditors and the court.

What kind of debts are dischargeable under Chapter 7 and Chapter 11?

In Chapter 7 Bankruptcy in Chicago, many types of unsecured debts can be discharged, including credit card debt, medical bills, and personal loans. However, certain debts like student loans, child support, alimony, certain tax obligations, and criminal fines are typically non-dischargeable.

In Chapter 11 Bankruptcy, a business in Chicago can restructure and discharge various types of debts as part of its reorganization plan, but obligations like long-term secured debts might be restructured rather than discharged.

When you need bankruptcy help, turn to the team you can trust at Therman Law Offices, LTD. Associate attorney Anthony Garcia was trained by Mr. Therman and represents those in need. Our Chicago bankruptcy attorney is here to help you now.

Therman Law Offices, LTD Chicago Bankruptcy Lawyer

8501 W Higgins Rd #420, Chicago, IL 60631

Google Review

“I couldn’t be happier with the services I received at Therman Law. They took care of all of my needs in a timely manner, were easy to get in touch with and answered all of my questions. Mr. Therman, Anthony and Kelly all worked diligently to ensure I relieved a fair settlement in a reasonable amount of time! Absolutely recommend!!” – Jen H